LOAN REQUEST

Payday & Personal Loans

Get up to $3000

Online loans for anything you need!

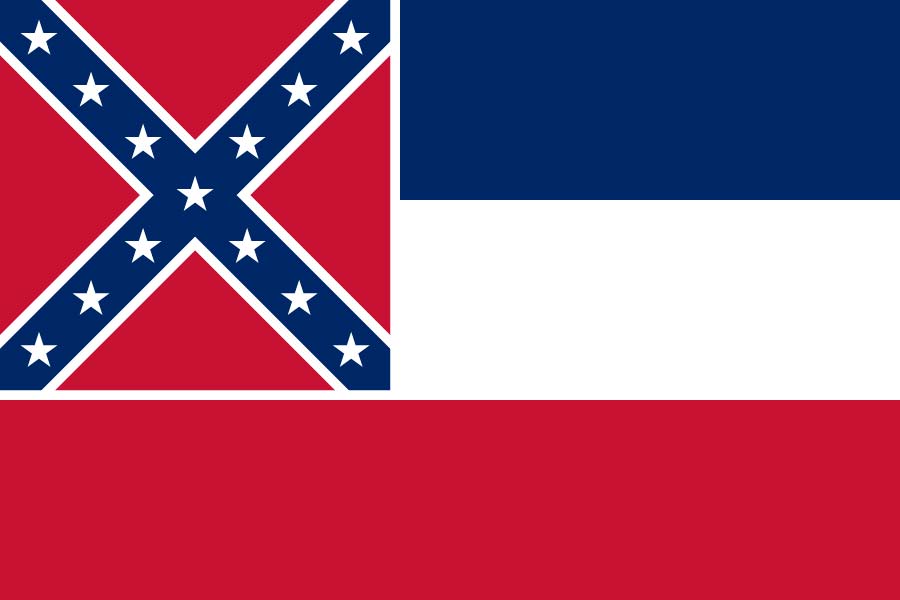

Start your personal loan application today!Loans in Mississippi (MS)

Payday Loans in Mississippi (MS) – The Risks Implied

Mississippi is the poorest state in all America. Studies show that the poverty rate is well above 20% while the national average is 13%. This is overwhelming when you think about the history that this state has behind. To make matters worse, the total household income is around $40,000, short of the national average that is $56.000, while the average for unemployment is 6.5%. Another concerning statistic shows that most fees due to late payments are registered in Mississippi.

The above being stated, the residents of Mississippi are getting desperate to cover their bills, so they turn their heads to a solution that may get them out of trouble. Online payday loans in Mississippi will probably get them out of the mud for a while. But payday loans may as well be equal with gambling with the devil in this situation.

Mississippi having a shortage of good old traditional banks, the number of payday direct lenders has sky-rocketed.

The Basics of Mississippi Payday Loans

Once you decide upon getting a loan, be sure to check the local market for an appropriate lender. They usually don’t come cheap in this state. However, some lenders will include in the $500 limit the fees. This actually is the only good part. The maximum length of a loan in this state is 30 days for a loan of $250 and 28-30 days for a loan that exceeds $250. They may seem accessible to everyone but take all safety precautions.

Depending on the lender, you will receive the money in little to no time. however, if you fail to pay the loan in a certain amount of time, the fees could join the game and it won’t be a good game to play.

Request a Loan:

As stated above, some states, including Mississippi, are responsible for almost half of the national fees. So, be sure check your account when engaging in payments. Also, before engaging in getting a loan, be sure to have all your documentation checked and up to date and a stable job.

An important aspect is to keep a close eye on whatever payments you make to your lender because several scams could occur. These scams consist mainly in the lenders asking for extra money to cover another previous loan. In this case, the best way is to report them. Also, keep a close and professional attitude with the lender and respect all the deadlines. Otherwise, you will end up in a greater debt than you were before.

Mississippi installment loans

Do you need longer term payday loan? With us you can get an online installment loan if you live in Mississippi. Request an installment loan here with fast approval.

Final Thoughts

To conclude the above statements, getting payday loans in MS and getting out of debt will definitely be a challenge. By keeping a close eye on your funding, you may be able to get away from whatever put you in debt. As a friendly advice, do not borrow more than you can afford, or else you will be trapped in a debt circle and that’s hard to get out of. Almost all obstacles are to be jumped across with a good understanding of payday loans.

Have a question?

Cash Loans

Our Company